Like any other market, currency prices are set by the supply and demand of sellers and buyers. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question. The new system is designed to operate in an orderly, smooth and efficient manner from 2027, while monitoring and reporting starts already 2025. Its cap is set to achieve 42% emission reductions in 2030 compared to 2005 levels, in line with the contribution of the sectors covered to the 2030 climate target. Elements of a smooth start include front-loading of auctioning of allowances in 2027, a Market Stability Reserve, a price stability mechanism for the initial years and mechanisms against excessive price increases. A safeguard has been put in place whereby if the price of oil or gas are exceptionally high in the run up to the start of the new system, this will be postponed until 2028.

We listen to society’s needs, and we use our deep understanding of the markets we serve to make supply more efficient, secure and sustainable. In his recent blog, Billy Hult, explains why he believes we’ll see more trading innovation in our markets over the next five years than we’ve experienced during any period since these markets began to go electronic in the late 1990’s. System response and account access times may vary due to a variety of factors, including trading volumes, market conditions, system performance, and other factors. MiFID II and MiFIR ensure fairer, safer and more efficient markets and facilitate greater transparency for all participants. Contrarian traders identify overbought or oversold conditions in conjunction with trend reversals.

REDES SOCIALES

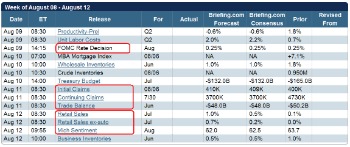

News or events can affect the price trends of the swing trader’s portfolio. The forward and futures markets are primarily used by forex traders who want to speculate or hedge against future price changes in a currency. The exchange rates in these markets are based on what’s happening in the spot market, which is the largest of the forex markets and is where a majority of forex trades are executed. Currencies are traded in the foreign exchange market, a global marketplace that’s open 24 hours a day Monday through Friday. Critical or significant commodity derivatives are defined in Article 57(1) of MiFID II as commodity derivatives with a net open interest above 300,000 lots over a one-year period. Article 57(3) of MiFID II requires ESMA to publish the list of critical or significant contracts.

- MiFID II and MiFIR ensure fairer, safer and more efficient markets and facilitate greater transparency for all participants.

- What they buy and sell are financial assets that include stocks, bonds, currencies, commodities, and derivatives.

- Our award-winning analytical solutions compress unstructured, big data into compact insights and iconic visuals that increase engagement, confidence and action.

Whether electronically, over the phone, or through a combination of both, Dealerweb gives market participants real choice to execute their trade strategy confidently. Pursue your goals with stocks, options, ETFs, mutual funds, and more. Layered insights across technical, fundamental, economic, sentiment & news proven to acquire & engage. MiFID II also establishes position reporting obligations to enable monitoring of compliance with the position limit regime and mandates the publication of weekly reports detailing aggregate positions held by different categories of market participants. The format and timing of those reports are specified in two Commission Implementing Regulations (ITS 4 and ITS 5).

Delivering emissions reductions

Under the European Climate Law, EU Member States will work collectively to become climate neutral by 2050. As a first milestone, the EU is aiming https://g-markets.net/helpful-articles/dragonfly-doji-candlestick-definition-and-tactics/ to reduce net emissions by at least 55% by 2030 compared to 1990. Get started today before this once in a lifetime opportunity expires.

- Also, with trading, liquidity is generated, enabling the quick transfer of stocks, bonds, futures, commodities, and currencies.

- Contrarian traders identify overbought or oversold conditions in conjunction with trend reversals.

- This is to anticipate future price movements in assets such as stocks, bonds, futures, currencies, or commodities.

- Future forecasts do not constitute a reliable indicator of future performance.

Start trading today with simple, intuitive, and powerful platforms designed to give you the ultimate experience. Stay on the forefront with easy-to-use tools to help cultivate your ideal trading strategy. Trade some of the most popular assets and pairs in premium conditions. In our latest blog, we take a closer look at how credit markets responded during the crisis and why it is clear that the ‘stickiness’ of electronic trading is here to stay. Tackle the markets with a package of resources engineered for those who love to trade. The information on this website is of a general nature only and does not consider your goals, financial situation or needs.

Forex

We set high standards for ourselves and our partners in our day-to-day activities. Decarbonising our world requires a collective, global effort by countries and companies working together. Trafigura is helping to decarbonise commodity suppy chains and provide a bridge to a low-carbon world. This whitepaper outlines the need for formalising artisanal and small-scale mined cobalt in the DRC in order to meet growing global demand for this metal critical to the renewable energy transition.

Illiquid agricultural commodity derivatives receive bespoke position limits in accordance with RTS 21a. Foreign exchange trading platforms match currency buyers and sellers in the spot, forward, and options markets. They sharply increase the amount of price information available to individual traders, thus narrowing price spreads and reducing commissions.

Global grievance hotline

After each year, an operator must surrender enough allowances to cover fully its emissions, otherwise heavy fines are imposed. If an installation reduces its emissions, it can keep the spare allowances to cover its future needs or else sell them to another operator that is short of allowances. A cap is set on the total amount of certain greenhouse gases that can be emitted by the operators covered by the system. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us. The real-time activity in the spot market will impact the amount we pay for exports along with how much it costs to travel abroad. We are proud of our meritocratic working environment – one that is forged in an atmosphere of integrity, ethical conduct, equal opportunity and mutual respect.

Forex is the largest market in the world, and the trades that happen in it affect everything from the price of clothing imported from China to the amount you pay for a margarita while vacationing in Mexico. Trading can be a high-stress and competitive profession, which isn’t suitable for everyone. When markets are in a downturn, there is a high potential for traders to lose their jobs. To be a successful trader, people often need to attain specialized education, training, and experience, which can be time-consuming and expensive. Those traders who work for themselves may have a home office or may rent one. If that isn’t the case, traders will have roles in investment banks, brokerage firms, proprietary trading firms, asset management firms, hedge funds, or exchanges.

The skills are a combination of technical, analytical, and behavioral qualities. It is a prerequisite for traders to be experts of the financial markets. MiFID II/MiFIR introduce new regulations for commodity derivatives to ensure that participants in commodity derivatives markets are subject to appropriate regulation and supervision and to improve the regulation and functioning of commodity derivatives markets. This would appeal to people who like being in a highly dynamic space. Traders can have the flexibility to work remotely and work nonstandard hours.

Trading Central’s annual Online Broker Summit rebrands to Digital Wealth Events

High conviction in the trades are required, as the contrarian view is often unpopular. Most people who trade on their own account work from home or in a small office, and use a discount broker and electronic trading platforms. Their limits are dependent on their own cash and credit, but they keep all profits. Their colleagues, clients, bosses, and other stakeholders need to quickly and effectively understand what their trader is saying so that they can make informed decisions. Trading is an intense profession, and traders need to effectively manage their emotions in a highly stressful environment. If you’re planning to make a big purchase of an imported item, or you’re planning to travel outside the U.S., it’s good to keep an eye on the exchange rates that are set by the forex market.

Traders gain significant exposure to the financial markets, as they have to actively and closely monitor them along with the factors that drive the respective markets. Traders use technical analysis and other market-timing information to identify buying and selling opportunities. They use charting techniques and momentum indicators such as moving averages and oscillators to accomplish this.

What they buy and sell are financial assets that include stocks, bonds, currencies, commodities, and derivatives. The profit generation is achieved through various approaches such as fundamental, technical and quantitative analyses, which aid in identifying market trends and opportunities. Stocks, bonds, currencies or foreign exchange, options, futures, commodities, cryptocurrencies, and exchange-traded funds (ETFs) are the most common type of assets that are traded. The asset class is dependent on the traders’ preference, expertise, and the market in which they operate.

ESMA is required to centrally publish the weekly reports on its webpage. Thanks to revenues from the emissions trading system for buildings, road transport and additional sectors, together with the Member States’ contributions, the Social Climate Fund will mobilise EUR 86.7 billion from 2026 to 2032. On 14 July 2021, the European Commission proposed to strengthen the EU ETS, extend emissions trading to new sectors and set up a new Social Climate Fund to address the impacts of carbon pricing on vulnerable groups. Fundamentals are generally gleaned from economic, industry-specific, and financial data and include economic data, industry trends, company news and events, and financial statements. At the heart of global supply, Trafigura connects vital resources to power and build the world.

The agreement entered into force on 1 January 2020, and the link became operational in September that year. Set up in 2005, the EU ETS is the world’s first international emissions trading system. It has since continued to inspire the development of emissions trading in other countries and regions. By 2030, the cap on emissions from sectors covered by the EU ETS is set to decrease by 62% compared to 2005 levels. The legislative framework for phase 4 of the EU ETS was first revised in 2018 in line with the EU’s 2030 climate and energy framework. However, in view of the European Green Deal and EU’s more ambitious climate targets, another revision of the EU ETS framework for phase 4 was launched in 2021.

This is essential to make informed decisions and be profitable in their activities. The types of information that traders access include fundamental, technical, or market timing, noise, and sentiment. With this information, traders can even develop a contrarian view or find arbitrage opportunities. Traders need to have a deep understanding of the asset classes, market dynamics, and various strategies in these markets. They need to figure out how to process large amounts of data quickly and correctly to make informed decisions about the financial markets in which they trade. A trader is an individual who engages in the buying and selling of assets in any financial market, either for themself or on behalf of another person or institution.